New figures from the Mineral Products Association (MPA) paint a grim picture of the heavyside market, with sales of construction materials stuck at “crisis levels” after four straight years of decline.

The MPA’s latest third-quarter returns show the construction sector on the ropes, with fragile activity, mounting job losses and capacity being stripped from the supply chain.

Across the country, ready-mix volumes dropped 12% year-on-year, continuing a downward trend that has seen sales fall in seven of the past eight years.

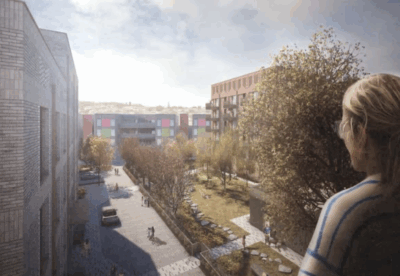

London was the hardest hit, with volumes plunging 32% over the past year as developers battle a stagnant housing market and planning bottlenecks for tall buildings under the BSR’s Gateway 2 regime.

The MPA said the slowdown had been made worse by weak commercial activity and delays to major infrastructure jobs, with only limited lifelines from ongoing public-sector schemes.

Sand and gravel sales dropped 3% in the third quarter, asphalt edged up 2.5% but remained below last year’s levels, and mortar volumes rose just 1% — still almost 30% below pre-2023 output after two years of steep decline.

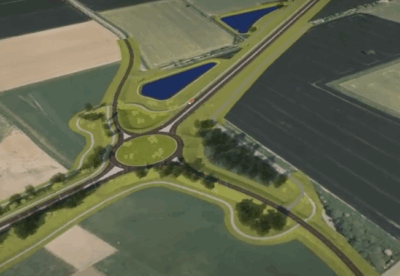

Even large infrastructure projects have lost momentum following the HS2 reset and the scrapping of nine major road schemes, slashing demand for key materials.

The MPA warned that many producers have been forced to mothball sites, cut capacity and shed skilled workers just to stay afloat.

MPA executive chair Chris Leese said: “Announcements about infrastructure and planning are all well and good, but for now they remain promises of ‘jam tomorrow’.

“Without urgent action that results in work on the ground now, the foundations of future delivery — investment, capacity and skilled labour — may not be there when the country needs them.”

In its Autumn Budget submission to the Chancellor, the MPA is calling for a package of pro-growth measures. These include a new super-deduction for investment in plant and machinery, faster delivery of approved infrastructure projects, and a housing stimulus to get stalled developments moving.

The association is also pushing for relief from high energy costs, and a more strategic use of public procurement to favour UK-made materials and protect jobs.

The MPA warned that unless the Government acts quickly, the prolonged weakness in materials demand will drain investment and skills from the industry, threatening the UK’s capacity to deliver future housing and infrastructure programmes.